Little Known Questions About Securities Lending & Borrowing.

The Best Guide To OCC - Stock Loan Programs - Options Clearing Corporation

The principal factor for obtaining a security is to cover a brief position. As you are obliged to provide the security, you will need to obtain it. At the end of the arrangement you will have to return an equivalent security to the lending institution. Comparable in this context indicates fungible, i.

ETF securities lending almost doubles in four years - Financial Times

Securities Lending - Overview, Applications, Benefits

the securities need to be completely interchangeable. Compare this with lending a ten euro note. You do not expect precisely the same note back, as any 10 euro note will do. As a result of Regulation SHO, embraced by the U.S. Key Reference , brief sellers typically must either have the shares they are offering brief or have a right to get them in order to cover the brief sale.

The System and method for securities borrowing and lending Statements

Extremely liquid securities are considered "easy"; these products are easily discovered on the marketplace must somebody decide to borrow them for the purpose of selling them brief. Securities that are illiquid in the market are classified as "hard". Due to different policies, a short sale deal in the United States and some other nations must be preceded by locating the security and amount that a person wish to have the ability to offer short in order to prevent naked shorting.

Securities lending term loan structure - Download Scientific Diagram

This list is described as an easy-to-borrow (shortened as ETB) list, and is also called blanket guarantees. Such a list is produced by broker-dealers based on "sensible assurance" that the securities on the list are easily available upon customer request. Nevertheless, if a security on the list can not be delivered as assured (a "failure to provide" would take place), the presumption of affordable grounds no longer uses.

How 5.7 Securities lending transactions - Viewpoint - PwC can Save You Time, Stress, and Money.

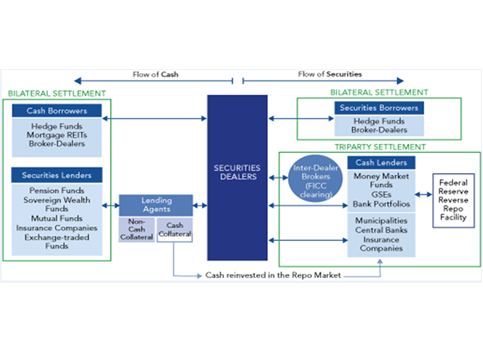

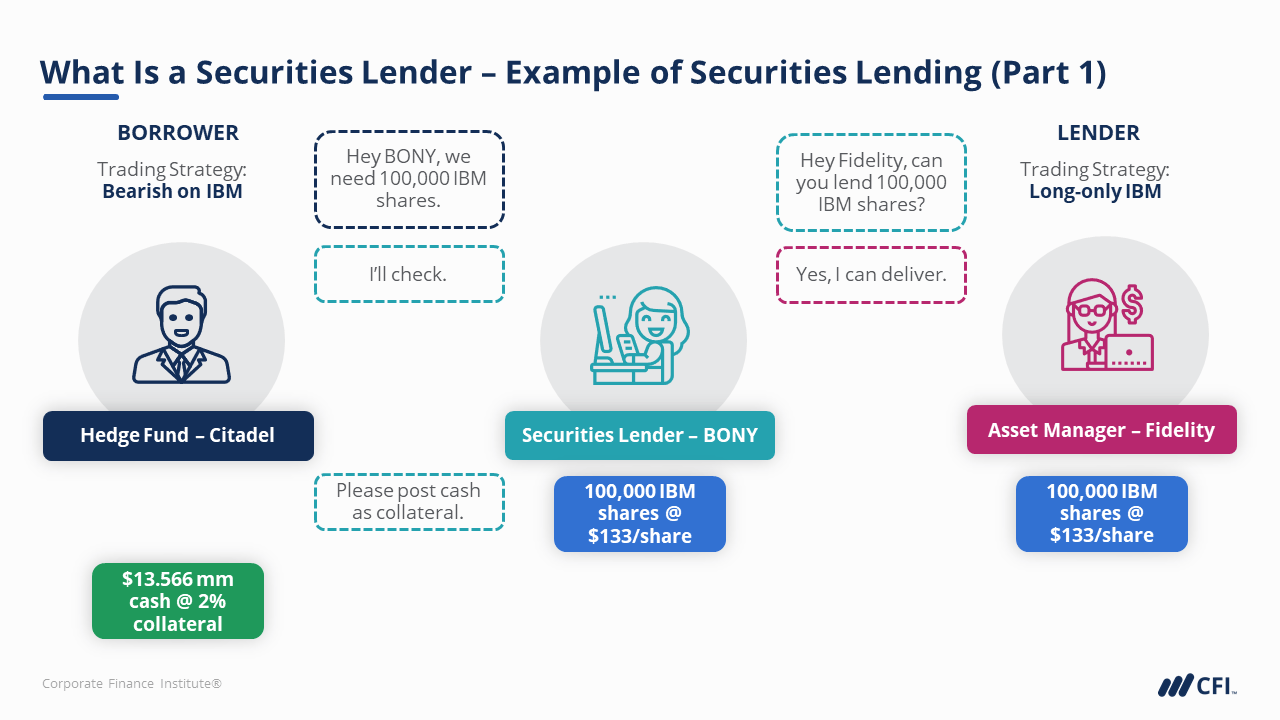

Securities lending institutions [modify] Securities lenders, typically merely called sec lending institutions, are organizations which have access to 'lendable' securities. This can be asset supervisors, who have many securities under management, custodian banks holding securities for 3rd parties or 3rd party lenders who access securities immediately via the property holder's custodian. The international trade company for the securities lending industry is the International Securities Financing Association.